- NEWS

- ABOUT YAMABIKO

- PRODUCTS

- IR

- SUSTAINABILITY

- NEWS

- CONTACT US

- Japanese

Interview with President & C.E.O

- Please tell us about the performance for the fiscal year ended December 2024.

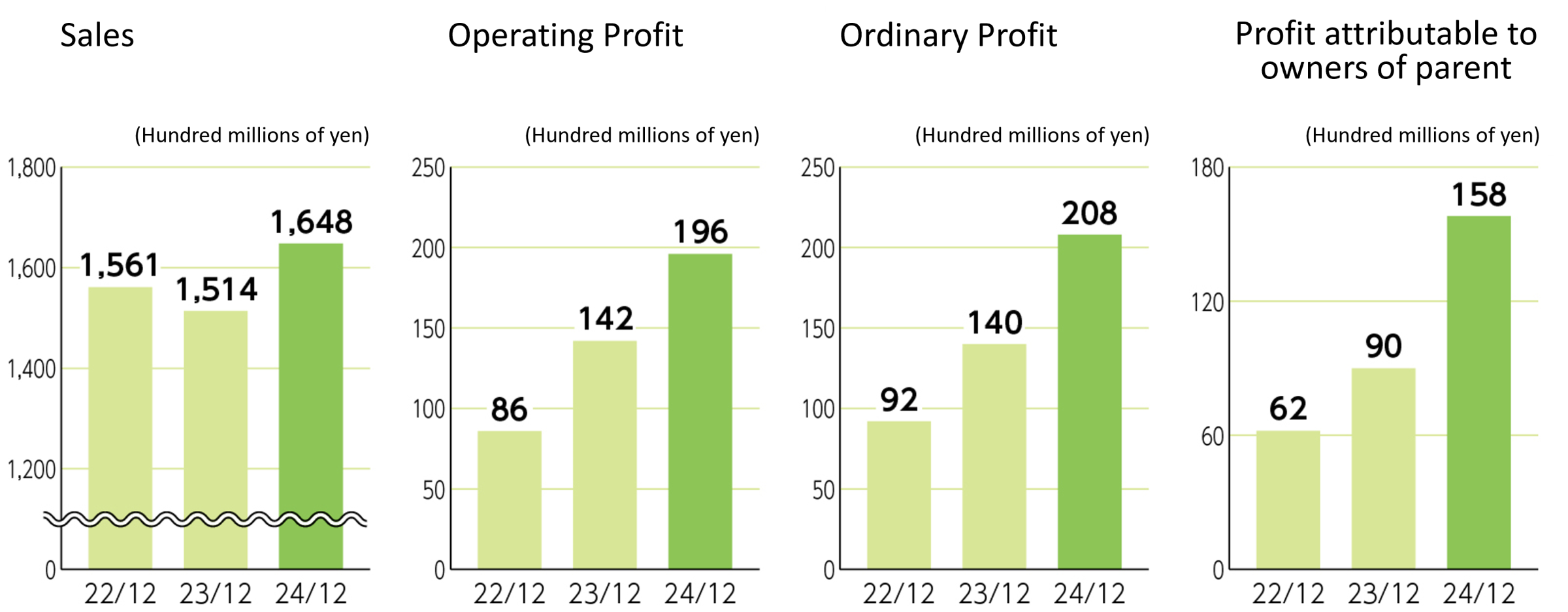

- The market environment surrounding the Group in the fiscal year ended December 2024 saw steady economic growth in the United States, while Europe showed signs of recovery but had not yet fully rebounded.

In addition, a gradual recovery continued domestically, supported by strong corporate earnings. Under these conditions, our main overseas OPE business performed well in the North American market due to the impact of promotions and favorable weather.

As a result, sales increased year-on-year in both overseas and domestic markets. Further, in terms of profit, we achieved record-high operating profit, ordinary profit, and net profit, supported by factors such as the liquidation of our Chinese production subsidiary, ongoing cost reduction efforts, price revisions, and the benefits of a weaker yen. -

- Please tell us about the outlook for the future.

-

For the fiscal year ending December 2025, which is the final year of our Medium-Term Management Plan 2025, we anticipate increased revenue due to a favorable business environment, particularly for North American OPE. However, in terms of the results of operations, we expect a year-on-year decline due to setting an assumed exchange rate based on a stronger yen, as well as increased selling, general, and administrative expenses from expanded investments in the areas of human capital and IT. Nevertheless, we anticipate exceeding the numerical targets initially set in the Medium-Term Management Plan.

That said, even while we take such outlooks into consideration, the Group’s external and market environments are constantly changing. To achieve sustainable growth in the future as well, we must respond swiftly and appropriately to these changes. In particular, with the increasing severity of natural disasters believed to be caused by global warming, we consider the pursuit of carbon neutrality a corporate social responsibility. To achieve electrification and reduce environmental impact, the Company will continue to develop carbon-neutral solutions, not only through our own efforts but also in collaboration with like-minded partner companies. In addition, in response to the aging workforce and declining labor population in the changing domestic agriculture and forestry sector, we will contribute to solving these challenges by developing labor-saving/energy-efficient and automation-based products.

Further, we will also continue our current efforts to expand the scale and profitability of existing businesses while focusing on creating new businesses for sustainable growth. We announced two new partnerships in February 2025. The first is a capital alliance with IKS Co., Ltd., a company with high-level expertise in storage battery and power conversion technologies. Through this alliance, we will strengthen our capabilities to develop new environmentally friendly power generation systems utilizing renewable energy and expand our lineup of power supply products.

The second partnership is a collaboration agreement with The Toro Company, a leading U.S. manufacturer of golf course management equipment. We aim to further expand our robotic solutions by leveraging the Company’s strengths in autonomous driving technology. Moving forward, we will continue to swiftly establish new business areas that will form the foundation of future revenue and achieve sustainable growth. - Finally, do you have a message for shareholders and investors?

-

The year 2024 marked the 15th anniversary of the merger between Kioritz Corporation and Shindaiwa Corporation, forming Yamabiko. We believe that the Group's equipment and services support people's lives in various fields, including green space management overseas, mountainous and hilly areas in Japan, and urban development sites both domestically and internationally.

We are confident that providing safe, reliable, and high-performance products and services to those working in these environments is our mission and the very purpose of Yamabiko’s existence.

We will continue to take on the challenge of creating new value, strengthening our management foundation, and enhancing corporate value. We sincerely ask for the continued support of our shareholders and investors.