- NEWS

- ABOUT YAMABIKO

- PRODUCTS

- IR

- SUSTAINABILITY

- NEWS

- CONTACT US

- Japanese

Interview with President & C.E.O

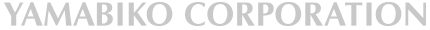

- Please tell us about the performance for the second quarter of the fiscal year ending December 2025.

During this interim consolidated accounting period, the overall business environment was favorable: consumer spending in the United States remained resilient, inflation eased in Europe leading to a recovery in consumption, and Japan continued to see a moderate recovery supported by improvements in income conditions.

Against this backdrop, our core overseas OPE (Outdoor Power Equipment) business performed steadily in North America, driven by favorable weather and the impact of our television commercials, particularly in the home center channel. In Europe, our new robotic lawn mowers sold well, while in Japan, stronger demand from farmers—supported by rising rice prices—boosted sales of rice field management sprayers and other equipment.

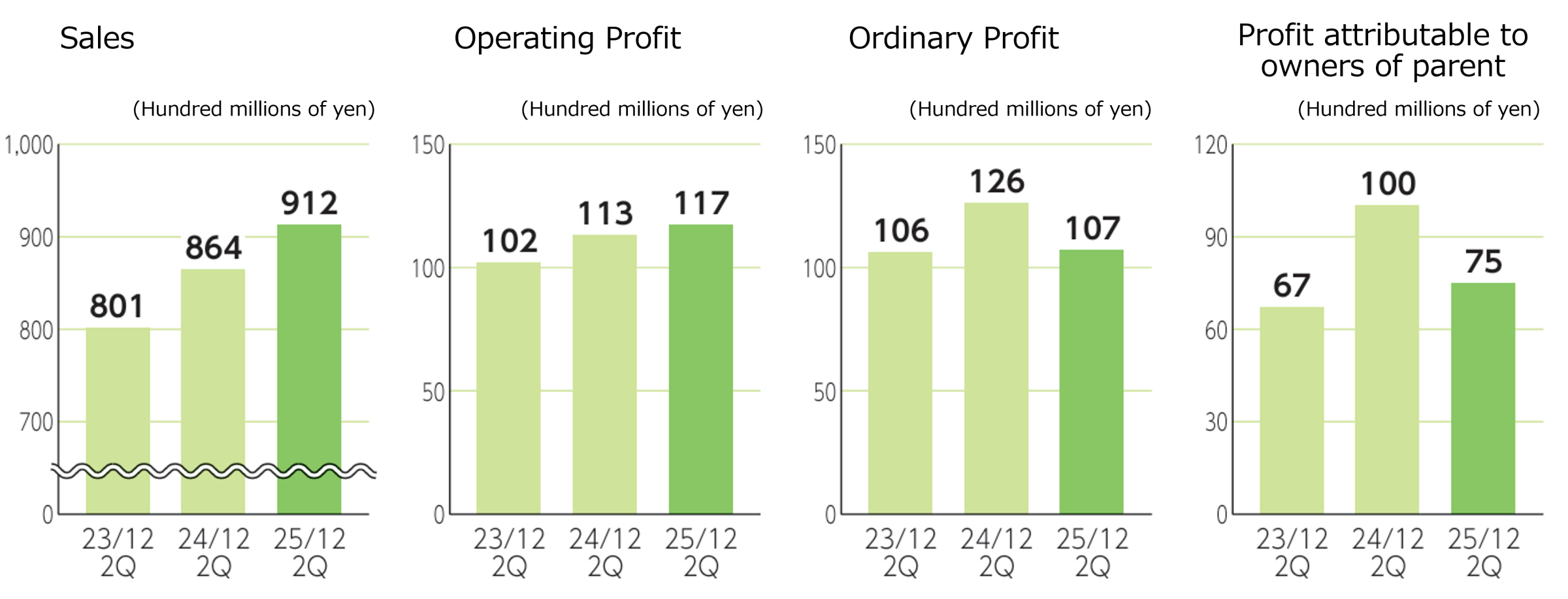

As a result, both overseas and domestic sales increased year-on-year, and operating profit also rose, supported by improved production efficiency. On the other hand, due to foreign exchange losses, ordinary profit and net profit attributable to owners of the parent declined.-

- Please tell us about the outlook for the future.

-

While uncertainties remain, such as U.S. trade policy, we have already taken comprehensive measures to address the tariffs imposed in April 2025. These include leveraging our U.S. production bases, accelerating production transfer plans, company-wide cost reduction initiatives, and optimizing the supply chain in collaboration with our partners. For the tariffs already announced, we are working to minimize the impact through pricing measures and expense reductions.

Based on these actions, we have not revised the earnings forecast for the fiscal year ending December 2025 from the guidance announced on May 13. However, reflecting current exchange rate levels, we have updated our assumptions for the third quarter onward to ¥145 per U.S. dollar (previously ¥140) and ¥165 per euro (previously ¥160).

-

- Finally, do you have a message for shareholders and investors?

-

This fiscal year marks the final year of our Medium-Term Management Plan 2025, and with the completion of the second quarter, we have reached the halfway point. Up to now, we have steadily strengthened our business foundation in markets centered on North America while expanding our product portfolio and sales channels. We are now extending this earnings base to global markets including Asia and Europe, while also broadening our existing product lineup and actively pursuing new business creation. By cultivating multiple growth drivers, we aim to balance management stability with sustainable growth.

In terms of new business initiatives, we launched sales of the “Multi-Hybrid System,” a power generation system contributing to carbon neutrality, in June. In addition, we established the “Yamabiko Kyoto Lab” within our partner company IKS Co., Ltd. to enhance our joint development capabilities. Furthermore, in August, we invested in i Labo Co., Ltd. to accelerate development of hydrogen engine generators toward demonstration and mass production, while also exploring future business models. These hydrogen engine generators were exhibited at Expo 2025 Osaka, Kansai, where they drew significant attention as next-generation environmentally friendly power sources.

Looking ahead, we will continue to advance both the strengthening of our existing business earnings base and the development of new businesses, thereby evolving our business portfolio. Through ongoing value creation, we remain committed to enhancing corporate value, and we sincerely ask for the continued support of our shareholders and investors.